Revenue Cycle Management in Healthcare Fully Examined Plus Key Steps and How to Address Challenges

What is Revenue Cycle Management (RCM)?

If you've ever received a medical bill or had to deal with insurance claims, you may have wondered how healthcare providers manage their finances. That's where healthcare Revenue Cycle Management (RCM) comes in.

Essentially, RCM is the process of managing the financial transactions between healthcare providers and patients throughout the entire healthcare experience.

At its core, RCM involves verifying patient insurance coverage, submitting claims to insurance companies, and processing patient payments. The ultimate goal is to ensure that healthcare providers receive proper compensation for their services while making it easier for patients to navigate the billing and payment process.

While the basic principles of RCM apply to all healthcare providers, its implementation can vary depending on the size and structure of the healthcare organization. For instance, a solo practice doctor may have a simplified RCM process compared to a larger healthcare organization with multiple departments and revenue streams.

Regardless of the size of the healthcare provider, RCM is an essential part of the healthcare industry. It ensures patients receive care while helping healthcare providers maintain financial stability.

Healthcare Revenue Cycle Management vs. Medical Billing

Revenue cycle management and medical billing are closely related, but they are not the same. Here are each broken down and described for comparison:

-

Medical Billing:

- Focuses primarily on claim submission, payment posting, and follow-ups related to reimbursement

- Is one component of revenue cycle management

-

Revenue Cycle Management:

- Spans the entire financial lifecycle of patient care

- Begins before the patient ever receives care, with insurance verification and eligibility checks, and continues after payment through collections, reporting, and performance analysis

- Provides the broader financial strategy that supports long-term stability for healthcare organizations

Front-End vs. Back-End Revenue Cycle Management in Healthcare

The revenue cycle management process is often divided into front-end and back-end activities. It's important that front-end and back-end teams coordinate, which reduces loss of uncollected revenue and improves cash flow:

- Front-end RCM includes patient registration, insurance verification, eligibility checks, and pre-authorizations. Errors at this stage frequently lead to claim denials and delayed payments.

- Back-end RCM begins after services are rendered and includes charge capture, coding, claims submission, denial management, payment posting, and patient collections.

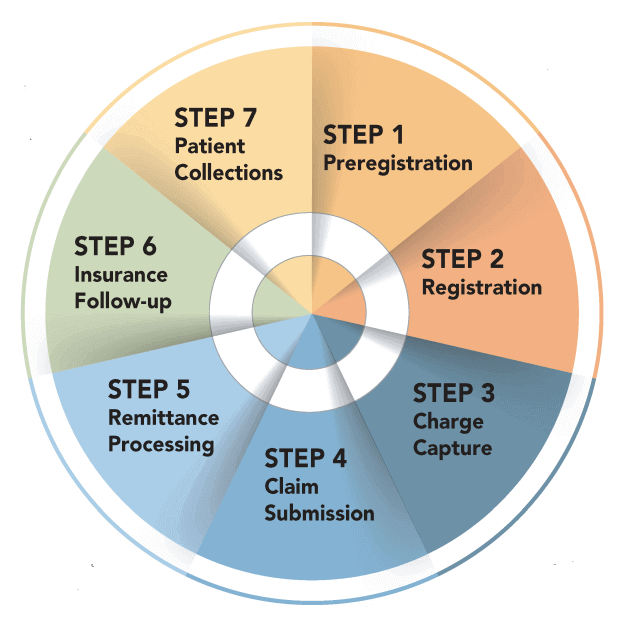

6 Key Steps in the Healthcare Revenue Cycle Management Process

Revenue cycle management in healthcare is a critical process designed to ensure patients, providers, and payers are on the same page about the medical billing and reimbursement cycle. For healthcare organizations, ensuring timely collection means they can continue to provide a high level of care using the most up-to-date technology. For patients, the process provides clarity around their obligations when receiving care and those of their insurance provider (the payer, if applicable).

The following six steps provide an overview of the main components of the Revenue Cycle Management process.

- Patient registration: The first step involves collecting and verifying patient information such as insurance details, demographics, and medical history. This step ensures that the patient's information is accurate and complete before they receive care. After this step, a patient can begin scheduling and attending regular appointments.

- Charge capture: This step involves capturing all the services and supplies provided to the patient during their visit. It ensures that all charges are recorded accurately to avoid any revenue loss.

- Claims submission: The medical billing team initiates the billing process by inputting the claim charges into a medical billing system or onto a CMS-1500/UB-04 form. Afterwards, they generate the claim and transmit it electronically or through paper to the clearinghouse, which processes it on behalf of the patient's insurance provider, who could be a government or commercial payer. Depending on coverage parameters, some insurance plans will require the patient to pay a deductible fee per reimbursement.

- Denial management (if necessary): After a claim, there may be instances of follow-ups on late payments or denials of services not covered. In the case of a denial, the healthcare provider can investigate the reasoning and resubmit the claim with amendments (if valid).

- Payment posting: This step involves recording the payment received from the payer or the patient, matching it to the corresponding claim, and posting the funds to the patient's account.

- Patient collections/follow-up: This step involves collecting the patient's outstanding balance after the insurance has paid their portion. This can be a straightforward process, though it can also involve patients unwilling to pay for reasons often attributed to misinterpretation of benefits, declined claims, expensive healthcare services, or other monetary challenges. As a result, it becomes the responsibility of the healthcare provider to reach out to the patient and retrieve the remaining balance.

Alternate Example:

The revenue cycle management process can vary in its number of steps depending on the organization and its stakeholders. Each healthcare organization will have its own unique process based on the software it uses, the payers it works with, and its patients' needs. For example, the RCM process depicted in the image above includes an additional step of preregistration and may have other categories that differ from the process outlined in our example. It's worth noting that there is no one-size-fits-all approach to RCM and that the process is subjective.

Vulnerability Assessments in Healthcare RCM

Vulnerabilities in revenue cycle management can wreak havoc on an unprepared organization. A vulnerability assessment in the RCM process is an evaluation of the organization's procedures, systems, and controls to identify weaknesses and potential threats that could impact its ability to generate or collect revenue.

This assessment is a critical step, as it helps identify areas where the organization may be vulnerable to errors, fraud, or other risks that can result in revenue losses. By conducting a vulnerability assessment, organizations can proactively identify potential issues and take corrective action to minimize or eliminate these risks, thereby improving the efficiency and effectiveness of their RCM processes. Compared to other steps in revenue cycle management, such as charge capture or claims processing, vulnerability assessment is a more proactive approach that can help organizations prevent revenue losses before they occur.

A few items to include in your RCM vulnerability assessment would be:

- Check for any manual processes or workarounds that can introduce errors or risks. Sometimes automating tedious tasks can reduce the chance for error.

- Identify areas where staff training or education may be needed to improve revenue cycle management. For example, you may consider assigning a specific person or group of employees to oversee the process.

- Analyze data to identify patterns and trends that may indicate vulnerabilities or risks.

Healthcare Revenue Cycle Management Challenges and How to Address Them

Revenue cycle management problems often build over time. Below are the most common challenges healthcare organizations face, along with how they are addressed and measured.

-

Revenue Cycle Management Challenges in Healthcare

-

Common Issues

Many common RCM issues start with basic information errors, and include:

- Incomplete or incorrect patient registration details

- Insurance eligibility or coverage issues

- Coding errors or missed charges

- Claims submitted late or with missing information

- High claim denial rates

- Slow reimbursement and long payment cycles

- Difficulty collecting patient balances

Manual work, staff shortages, and disconnected systems often make these problems worse. Over time, this can lead to lost revenue and higher administrative effort.

-

Compliance and Data Security Issues

Revenue cycle management involves frequent access to patient and billing data, creating compliance responsibilities, including:

- Protecting PHI during billing and payment activities

- Limiting access to sensitive data based on job role

- Keeping clear audit trails of billing and payment activity

- Ensuring secure data exchange between providers, payers, and vendors

Further, when third-party vendors support RCM activities, healthcare organizations must also verify that:

- A signed Business Associate Agreement (BAA) is in place

- Vendors follow HIPAA security and privacy requirements

- Vendor access and data handling are regularly reviewed

Weak controls in any part of the process can increase regulatory and security risk.

-

-

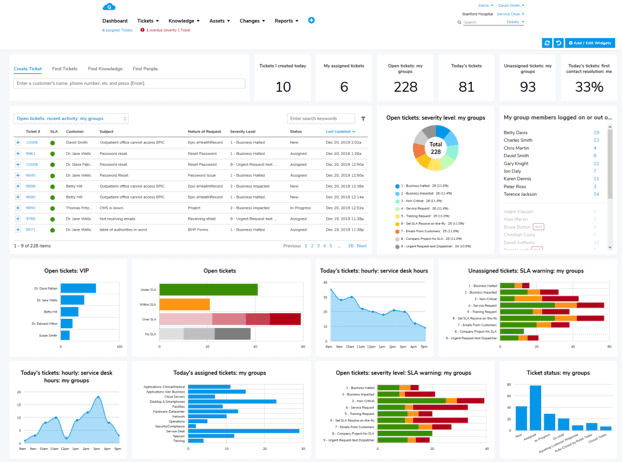

How to Address Healthcare RCM Challenges With Technology

Healthcare organizations can address many revenue cycle management challenges by using technology in the following practical ways:

- Use automation to fix errors early: Start by automating insurance verification, eligibility checks, and patient information intake. This helps catch issues before services are delivered, reducing denied claims and rework later in the process.

- Reduce manual work in billing and coding: RCM systems help limit manual data entry by pulling information directly from clinical and scheduling systems. This lowers the risk of missed charges, coding errors, and inconsistent billing.

- Apply AI to prevent and manage denials: AI-based tools can analyze past claims to identify patterns that lead to denials. These insights help teams correct issues before submission and focus follow-up efforts where they are most likely to succeed.

- Centralize claim tracking and follow-up: Software systems provide a single place to track claims, payments, and outstanding balances. This improves visibility, keeps staff aligned, and helps prevent claims from falling through the cracks.

- Support security and compliance controls: Modern RCM platforms also help enforce access controls, maintain audit logs, and support secure data exchange. These features play an important role in meeting HIPAA requirements and managing vendor access.

-

Measuring RCM Progress and Improving Over Time

Solving RCM challenges is not a one-time effort, and ongoing measurement is key. Common metrics used to track improvement include:

- Days in accounts receivable

- Clean claim rate

- Claim denial rate

- Net collection rate

Reviewing these metrics regularly helps teams:

- Spot problem areas early

- Measure the impact of process or technology changes

- Confirm that compliance controls are working as expected

- Adjust workflows before issues grow larger

The Bottom Line: Prioritize HIPAA-Compliance in the Revenue Cycle Management Process

While recognizing the importance of revenue cycle management, safeguarding PHI is equally important. The healthcare industry must prioritize protecting patient information throughout the RCM process. As we've discussed, there are many ways in which RCM can be vulnerable to cyber threats, such as phishing attacks, malware, and data breaches. However, there are ways to mitigate these risks, such as through regular vulnerability assessments.

HIPAA sets national standards for protecting sensitive health information, and compliance with its regulations is essential for safeguarding patients' data. By partnering with a HIPAA-compliant technology provider, healthcare organizations can ensure their RCM processes are secure and their patients' data is protected. This process should account for the storage of PHI and the exchange of information between the provider, payer, and patient.

Learn more: Giva's dedication to HIPAA compliant offerings

It's important to note that RCM companies are also held to the same high standards as healthcare organizations regarding HIPAA compliance. This means they must comply with the same regulations and standards to ensure the security and privacy of patients' information.

By taking these precautions, healthcare organizations can ensure their patients' information is secure and protected throughout the RCM process. This is essential for maintaining patients' trust and ensuring the continuity of healthcare operations.