Call Center Compliance: Risks, Key Laws and Regulations, and Best Practices

Customers expect more than fast, helpful service. They also expect businesses to protect their personal information. Call center compliance is harder today than it was before. New rules, higher expectations, and closer oversight have raised the bar.

For businesses, compliance is no longer about avoiding fines. It helps protect brand trust, deliver consistent service, and keep operations running smoothly.

These higher standards come from real changes in how contact centers work. Many teams now use remote or hybrid agents. AI tools are also common. These tools can improve efficiency, but they can also create new risks. Customers now expect clearer rules, stronger security, and better control over their data.

What Call Center Compliance Really Means in Modern Contact Centers

In simple terms, call center compliance means following laws and internal rules. These requirements can vary by location and business type. In practice, compliance affects how calls are made, how data is handled, and how agents interact with customers.

Compliance is not only a legal requirement. It also matters to customers. They expect businesses to protect sensitive information. This includes names, home addresses, and credit card details. Excessive follow-up emails or unwanted cold calls can feel intrusive and unethical. For businesses, compliance helps create clear and repeatable processes. These processes are easier for customers to follow and teams to manage. It becomes part of daily operations, not an audit task.

To understand what ethical compliance looks like in practice, consider a few basic questions:

- Do you get proper consent before calling or recording a customer?

- How do you verify customer identity, and is that information stored securely?

- Who can access sensitive customer data, and is that access necessary?

- When required, do agents follow call center scripts or disclosures to reduce risk?

Compliance has expanded as contact centers have changed. Three major factors drive this shift:

- Remote and hybrid agents: Businesses need clear oversight to ensure teams follow consistent standards, no matter where they are based.

- Cloud-based contact center platforms: Organizations must understand how automated workflows and decisions function in the cloud.

- AI-powered tools: Quality assurance, call monitoring, and analytics require clear accountability for AI-assisted interactions.

Modern contact centers should not wait for a complaint or a fine. Compliance works best when it is built directly into everyday workflows.

What Call Center Compliance Covers

Call center compliance applies across the entire customer interaction, which includes the technology, processes, and people. Some examples are:

- How and when calls are placed

- Whether consent is properly obtained and documented

- How customer identity is verified

- How call recordings and transcripts are stored

- Who can access sensitive customer or payment data

- How opt-out and preference requests are handled

Why Call Center Compliance Is No Longer Optional

In the past, many businesses treated compliance as a background task. Today, it directly affects how contact centers operate and grow. A single mistake can impact hundreds or even thousands of customer interactions. Not to mention your bottom line.

Compliance has evolved alongside changing regulations. Requirements now vary by region, industry, and communication channel (ex. phone vs. email). This makes it hard for contact centers to rely on outdated policies. Regulatory agencies such as the Federal Trade Commission and the Consumer Financial Protection Bureau actively enforce consumer protection and telemarketing rules that affect contact centers.

The cost of getting compliance wrong is higher than many organizations expect. Compliance costs can include regulatory fines, legal fees, and time spent investigating issues. In some cases, violations become public and cause long-term brand damage. This type of damage is often harder to recover from than financial penalties.

The Real Risks of Ignoring Call Center Compliance

Compliance issues don't just disappear. When compliance breaks down, the impact can be immediate and far-reaching. These risks affect finances, day-to-day operations, customer trust, and long-term growth.

-

Financial and Legal Exposure

One of the most serious risks of non-compliance is financial and legal exposure. Fines and legal action often scale based on the number of calls or consumers affected.

Example: In January 2024, the Federal Trade Commission (FTC) reached a settlement with Response Tree, LLC, a lead generation company. The company was accused of collecting consumer data without proper consent. They then sold this data for illegal telemarketing. As part of the settlement, Response Tree was banned from making or assisting telemarketing calls. This case shows how compliance failures can lead to more than fines. It can shut down core business activities.

-

Operational Disruption

Compliance issues also disrupt day-to-day call center operations. Investigations can force businesses to pause campaigns, change scripts, or limit outbound activity.

Example: In early 2024, the FTC took action against XCast Labs, Inc. The company was accused of allowing hundreds of millions of illegal robocalls through its network. This shows that compliance failures can lead to restrictions and ongoing supervision.

-

Damage to Customer Trust

Customers notice quickly when compliance breaks down. There is little tolerance for unwanted outreach or mishandled data. A single unauthorized call or one lapse in data handling can lead to turnover, negative reviews, and lost sales. When these issues become public, they often result in long-term brand damage. Many times, this is far harder to repair than the original mistake.

-

Data and Security Risks

Weak compliance controls also increase the risk of data theft. Customer records, payment details, and call recordings can be easily exposed by the "bad guys". Even when a potential infraction is caught early, organizations may still face audits and reporting duties.

-

Agent-Level Risk

Agents are on the front lines of compliance. Gaps often surface through daily interactions, even when mistakes are unintentional. Without clear rules and ongoing training, agents may unknowingly violate policies. This puts both themselves and the business at risk. Consistent compliance training helps reduce errors while giving agents more confidence.

Key Call Center Compliance Laws and Regulations You Must Follow

Call centers operate under a wide range of laws and regulations. These rules govern how calls are placed, how data is handled, and how customer consent is managed. Requirements vary by region, industry, and call type. This section will primarily focus on regulations that apply to call centers operating in the United States.

-

Telemarketing Sales Rule (TSR)

The Telemarketing Sales Rule sets standards for telemarketing activities in the United States. Its primary goal is to protect consumers from unwanted telemarketing calls. This includes those that contain deceptive and abusive telemarketing practices.

The TSR establishes requirements around calling hours, required disclosures, consent, and opt-out mechanisms. It also restricts certain sales tactics and mandates clear identification of the caller and purpose of the call. Call centers that use outbound sales or lead generation must follow TSR requirements.

-

TCPA (Telephone Consumer Protection Act)

TCPA requirements govern how businesses contact consumers by phone and text message. The law places strict limits on calls to cell phones. This is particularly for when using pre-recorded messages or auto dialers.

Under the TCPA, businesses must obtain prior express consent before making some types of calls. Violations can result in lawsuits and penalties. These penalties often increase with the number of calls made. Because of this, TCPA compliance is a major risk area for outbound contact centers and automated calling campaigns.

-

National Do Not Call Registry

The National Do Not Call Registry allows consumers to opt out of receiving telemarketing calls. Businesses must scrub call lists against the DNC Registry before placing outbound calls.

Calling numbers listed on the registry without permission can result in enforcement action. Businesses must keep accurate call lists and honor opt-out requests.

-

GDPR (EU-Specific)

The General Data Protection Regulation legal framework applies to businesses that handle data from people in the European Union. GDPR compliance requires clear consent and transparency on how data is used.

While GDPR is EU-specific, U.S. call centers that interact with EU residents or process EU customer data may still be subject to its requirements.

-

PCI DSS (Payment-Related Calls)

Payment security is one of the most sensitive areas of call center compliance. PCI DSS governs how businesses handle payment information during transactions. PCI DSS compliance focuses on protecting cardholder data during processing, transmission, and storage.

Call centers that accept payments by phone must use security controls to protect credit card details. Failures in this area can lead to fraud and long-term trust issues.

-

HIPAA (Healthcare Contact Centers)

The Health Insurance Portability and Accountability Act (HIPAA) applies to healthcare providers and their partners. This includes contact centers that handle patient communications. HIPAA compliance regulates access to patient data and health information.

Call centers that support healthcare organizations must limit access to sensitive health information. They must handle recordings and transcripts securely and keep proper documentation. Violations can trigger audits, fines, and mandatory reporting obligations.

Read more: Giva's Ultimate 10-Step IT HIPAA Compliance Checklist (Free PDF)

Read more: 5 Top HIPAA-Compliant Help Desk Software Solutions

Inbound vs. Outbound Call Center Compliance

It should be noted that compliance requirements can often be applied differently based on whether the call is inbound vs. outbound:

- Inbound calls are usually less restricted, but still must comply with data privacy, call recording consent, and industry-specific regulations such as HIPAA or PCI DSS.

- Outbound calls typically face stricter rules around consent, disclosures, calling hours, and opt-outs. Laws like TCPA, TSR, and Do Not Call apply most heavily here.

How AI and Automation Are Changing Call Center Compliance

Artificial intelligence is changing the world of work and this is also true for today's contact centers. It can be argued that not embracing AI may even lead to competitive disadvantages.

AI in contact centers can assist or fully control how calls are monitored, routed, recorded and reviewed afterwards. The main benefit is that automation allows contact centers to handle more interactions at a faster pace.

The risk? Small compliance errors can now affect many customers at once.

However, it's not all negative. When used for call monitoring and quality assurance, AI tools can change how teams identify potential issues or business trends. In fact, this technology can automate both processes when implemented correctly.

While it can surface risks and trends, it does not replace accountability. Therefore, human oversight is still important and necessary.

Best Practices for Building a Sustainable Call Center Compliance Program

Compliance works best when it is built into daily operations, not treated as a one-time project. A sustainable compliance program relies on clear processes. These processes must be consistent and visible.

- Assign clear ownership. Every compliance program needs a defined owner. This may be a compliance officer or another designated leader. That person handles enforcement and oversight.

- Document policies and keep them current. Written compliance policies should reflect current laws, internal standards, and operational realities. Review these documents regularly as regulations and processes change.

- Train agents early and often. Initial onboarding is not enough. Ongoing compliance training helps agents stay informed. It also helps them keep up with changing workflows and regulations.

- Track interactions consistently. Regular call monitoring and review can help identify issues before they become violations. Consistent oversight also reinforces expected behavior and policy adherence across teams.

- Audit processes, not only outcomes. Internal audits should happen quarterly or more frequently. They should focus on how work is done, not only on incidents or complaints. Reviewing workflows, scripts, and access controls helps uncover hidden risks.

-

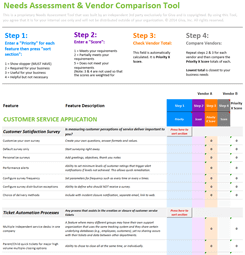

Use software to centralize and automate compliance efforts. Compliance becomes harder to manage as call volume and complexity increase. Call center software can help centralize documentation, automate monitoring, and maintain audit trails.

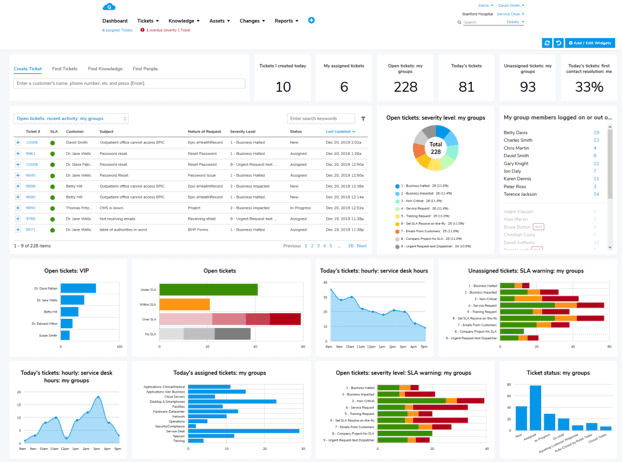

For example, Giva's Customer Service Software allows teams to document requests, track actions over time, and control access based on role. This creates a clear record of how issues are handled. It's a great way to support process reviews and audit readiness.

Basic Call Center Compliance Checklist

While requirements vary by industry and region, most compliant call centers implement these processes, although regulated industries often require additional measures:

- Clear consent for calls and recordings

- Accurate caller identification and disclosures

- Secure storage of call recordings and transcripts

- Role-based access to customer data

- Regular agent compliance training

- Ongoing call monitoring and QA reviews

- Documented opt-out and preference management

- Internal audits of scripts, workflows, and access controls

Frequently Asked Questions About Call Center Compliance

-

What is call center compliance?

Call center compliance means following laws and internal rules. These rules guide how customer interactions are handled. This includes how calls are made, how data is stored, and how consent is managed.

-

Who is responsible for compliance in a call center?

Responsibility typically falls to a compliance officer or a designated leader. That role oversees policy enforcement, training, audits, and ongoing oversight across teams. However, senior leadership is ultimately accountable for ensuring compliance programs are in place and enforced.

-

Does call center compliance apply to remote agents?

Yes. Compliance requirements apply regardless of where agents work. Remote agents must follow the same policies as on-site teams related to the jurisdiction where services are offered.

-

How often should compliance training take place?

Compliance training should be ongoing. Initial onboarding is important. Regular refreshers help agents keep up with changes to regulations, scripts, and workflows. Aim for quarterly updates, though more frequent can be good too if possible.

-

Are outbound calls more heavily regulated than inbound calls?

In many cases, yes. Outbound calls are often subject to stricter consent, disclosure, and opt-out requirements, especially for sales and marketing activity.

-

What is required for call recording and monitoring compliance?

Call centers must notify customers of recording, secure the recordings and transcripts, restrict access to them by authorized users only, and follow defined retention and deletion policies.

-

Can AI tools be used in a compliant call center?

Yes, but businesses remain responsible for compliance. AI can support monitoring and quality assurance, but it does not replace human oversight or accountability.

-

What happens if a call center fails to follow regulations?

Non-compliance can lead to fines, legal action, audits, and reputational damage. In some cases, violations may also result in operational restrictions or increased oversight.

Final Thoughts: Creating a Culture of Call Center Compliance

Call center compliance is no longer a box to check or a task reserved for audits. It's an ongoing commitment that affects how teams operate, how customers are treated, and how businesses grow. Regulations change over time. AI and automation, while helpful, leave less room for error.

The most effective contact centers treat compliance as part of their culture. Clear ownership and consistent training help teams stay aligned. Regular monitoring and well-documented processes support confidence in daily work. When compliance is built into daily operations, it supports better customer experiences. It reduces risk and creates a stronger foundation for long-term success.

Giva Software Can Help Keep Your Call Center Support Compliant

If you're ready to take the next step, Giva's customer service solutions are automatically HIPAA compliant, with robust security measures, and built for quick deployment and ease of use. That way, you can start seeing value right away:

- Use Giva's AI Copilot to help agents craft the best responses to customers

- Help users find the best responses to questions from your knowledge base using Giva's Knowledge AI Copilot

- Get visual insights with real-time dashboards

- Make fast business decisions with out-of-the-box reporting and analytics

Learn how Giva can benefit your support organization. Get a demo to see Giva's solutions in action, or start your own free, 30-day trial today!